If you are a company that operates in the manufacturing ecosystem, one of the most cost-effective ways to build trust, create competitive advantage and generate leads is thought leadership. Thought leadership is content that delivers expertise, guidance or a unique perspective on a professional topic or field.

How to Bolster Your Thought Leadership with Research and Data

If you are a company that operates in the manufacturing ecosystem, one of the most cost-effective ways to build trust, create competitive advantage and generate leads is thought leadership. Thought leadership is content that delivers expertise, guidance or a unique perspective on a professional topic or field.

But whether it takes the form of a blog post, podcast, presentation, whitepaper research report or some other format, the distinguishing feature of thought leadership is that it is original. Thought leadership, properly understood, communicates an idea or finding or trend or insight that no one else is talking about.

Two ways to publish original thought leadership are to leverage research and data. When your thought leadership is original, your audience takes notice. And when your thought leadership is based upon your own research and data, they take you seriously.

Let’s walk through the process of creating original, fact-based thought leadership. Consider, for example, the process that the team at RH Blake followed to create our 2025 Thought Leadership in Manufacturing Report: Thought Leadership’s Impact on Long Sales Cycle Offerings in the Manufacturing Ecosystem.

Step 1: Determine your perspective

Every piece of thought leadership you create has to have a central point of view. There must be a primary theme, an overall point, that you intend to communicate. This is the “thought” in thought leadership. You must pick this thought before you conduct any research.

Your point of view needs to be compelling, which means it must challenge conventional wisdom, debunk a common misunderstanding, solve a pressing problem, and so on. This point of view establishes your “Big Why” for conducting your research.

As you can see from the title of our report, our thesis was that thought leadership affected decision-making in long-sales-cycle offerings in the manufacturing ecosystem. In other words, we knew that decision-makers in the manufacturing ecosystem (that is, manufacturers and suppliers) were influenced by thought leadership when purchasing products and services that involved long sales cycles.

But we wanted to dig deeper on how much they are impacted, when they are impacted, and how. This would help the market and our customers make better-informed decisions around their marketing programs. So, we decided to conduct original research to prove our point of view.

Step 2: Uncover insights

To create effective thought leadership that’s based on real-world data, you gather that data through research, observation, and information gathering, typically using a mix of qualitative and quantitave research. You have a number of methods to choose from.

- Reviewing primary sources: Primary sources, such as technical manuals, patents, industry reports and internal documentation, provide manufacturers with authentic and detailed data. By analyzing these resources, companies can uncover unique insights about trends, innovations or operational efficiencies that competitors might overlook. For example, examining historical production data or engineering specifications can reveal patterns or best practices that serve as the foundation for authoritative content.

- Interviewing industry stakeholders: Interviewing customers, suppliers, employees and industry experts is a powerful way to gather first-hand perspectives. These interviews can uncover pain points, success stories and emerging challenges within the industry. By presenting these voices in their thought leadership materials, manufacturers not only lend credibility but also align their content with the real-world concerns of their audience.

- Conducting focus groups: Focus groups provide a controlled environment to gather qualitative insights from a selected audience. Whether engaging customers to explore product perceptions or industry peers to discuss trends, focus groups reveal deep insights that are often inaccessible through other methods. Manufacturers can use these sessions to test a thesis or hunch, validate assumptions, and refine their thought leadership based on direct feedback.

- Running surveys: Surveys are a versatile tool for collecting both qualitative and quantitative data at scale. By designing targeted surveys distributed across a well-defined sample, manufacturers can gather actionable insights on topics ranging from market trends to customer satisfaction. Online survey tools make this approach cost-effective and efficient, and the aggregated data can be used to create charts, reports, and insights for thought leadership pieces. This is the research method that we used to create our 2025 Thought Leadership in Manufacturing Report.

- Analyzing industry data: Sometimes, the most valuable insights come from studying existing industry datasets, such as government statistics, market research reports and trade publications. By synthesizing and contextualizing this data, manufacturers can identify trends, gaps and opportunities that resonate with their target audience. Offering a unique interpretation of widely available data can position a manufacturer as a thought leader without the need for primary data collection.

Each of these methods can yield valuable insights when executed correctly, providing the foundation for thought leadership content that is both relevant and authoritative. By using one or more of these approaches as needed to suit the type of content being created, manufacturers can ensure their research is robust, credible and aligned with their audience’s needs.

Step 3: Avoid bias

Your thought leadership is only valid if it is impartial. If your blog post or whitepaper or research report sounds like a product brochure, you are sunk. Thought leadership must be impartial because its primary goal is to build trust, credibility and authority within the industry. When content is overtly self-promotional or biased, it risks being dismissed as marketing material rather than a genuine contribution to the field. Impartiality ensures that insights, recommendations and conclusions are rooted in evidence and objectivity, which strengthens the audience’s perception of the brand as a trusted advisor. By focusing on solving real problems, addressing industry challenges and exploring trends without favoring your own products or services, you foster deeper engagement and respect from your stakeholders, establishing your organization as a leader whose opinions truly matter.

In our 2025 Thought Leadership in Manufacturing Report, we avoided bias in a number of ways:

- Sample size: We surveyed 300 respondents. Adequate sample size is crucial when conducting surveys because it ensures the results are statistically reliable and representative of the larger population.

- Geography: Since many of our customers sell globally, any findings from our research had to apply globally. So, we surveyed respondents from Canada, Germany, the United Kingdom and the United States.

- Randomness: Randomness is crucial when selecting respondents for surveys because it ensures the sample is unbiased and representative of the larger population. By randomly selecting our survey participants, we avoided biases that would skew our results, such as over-representing a size or type of manufacturer.

- Relevance: Although we chose our survey respondents randomly, we ensured that they were relevant. We made sure they met some strict criteria so that anything they told us was relevant to our research—and to our report. We screened all participants to isolate individuals who:

-

- Work for a company that sells physical or digital products to manufacturers and process industries

- Are involved with purchasing products that have sales cycles of three months or more

- Participate in purchase decisions for products or services in their company

Step 4: Ask the right questions

The most effective thought leadership answers a pressing question, solves a common challenge, corrects a misunderstood belief, explains a growing trend, or in other ways communicates a message that is topical, timely and trustworthy. To do this, you must ask the right questions. In your research, you must ask only those questions and search only for those facts and data points that either prove or disprove your thesis.

In our report, for example, our point of view was that thought leadership affected decision-making in long-sales-cycle offerings in the manufacturing ecosystem. To provide deeper and more-specific insights, we had to ask our survey respondents the right questions. These questions included:

- Where do you routinely seek information when researching a product, service, or industry trend?

- How much time per week do you spend reading and viewing thought leadership content?

- What are your preferred formats for thought leadership content?

- During which stage of the buying process do you utilize thought leadership?

Step 5: Turn answers into insights

Raw data is seldom useful. Facts and figures usually only makes sense to your audience when you give them context. So, in your thought leadership, resist the temptation to simply dump a bunch of data into a document, hire a designer to make it all look pretty, and then hit publish. The key question in thought leadership isn’t “What?” It’s “So what?” Your research and data are only helpful when they show your audience how to solve a problem or meet a challenge.

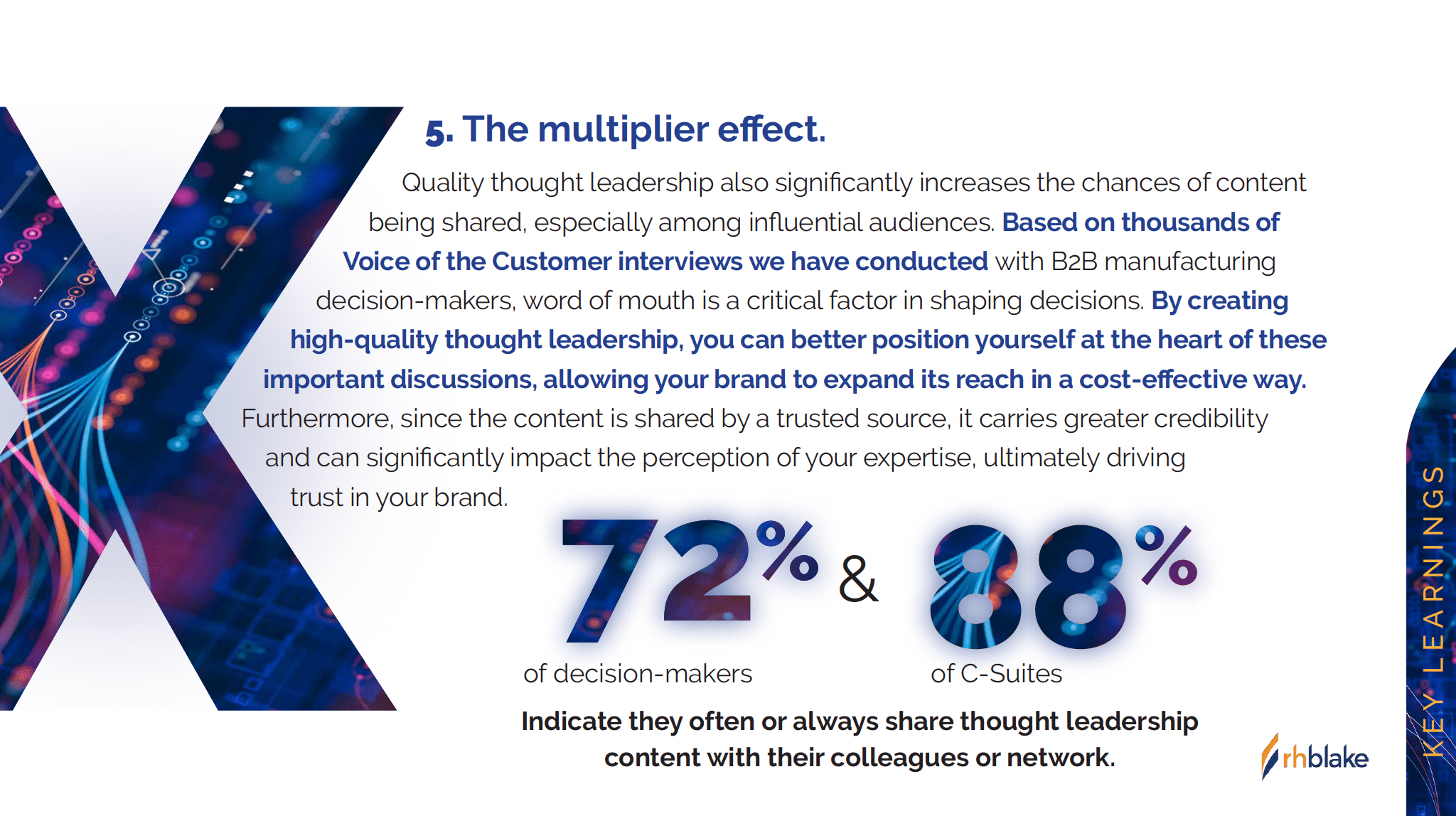

For example, in our research, we discovered that 72% of decision makers “often or always share thought leadership content with their colleagues or network.” But this bare fact all on its own is not enough. It’s easy to read and then to ignore. What we needed to do was hunt for the insight behind this statistic, to discover the real-world relevance of this finding, to help our audience appreciate the real-world implications of this fact. So, we examined this data point, and spelled out for our readers why it was important to them. We preempted the “So what?” question. Here’s what we wrote (page 18 of our report):

Notice the insights buried behind that 72% statistic.

Quality thought leadership:

- Significantly increases the chances of your content being shared among influential audiences

- Positions your organization at the heart of B2B manufacturing buying decisions

- Allows your brand to expand its reach in a cost-effective way

- Carries greater credibility among prospects than promotional messages

- Elevates your expertise

- Increases trust in your brand

Step 6: Draw a picture

Typically, the most effective way to present data is visually. That is, to present numbers and percentages visually. Sentences and paragraphs have their place, but the secret to conveying complex findings a persuasively as possible is to render them as a visual. For instance, we asked our survey respondents to rate the importance of thought leadership using a scale from not important at one end to very important at the other end. Then we rendered our findings as a visual that illustrates how important thought leadership is to decision-makers.

At a glance, this chart quickly communicates two vital findings from our study:

- The C-suite has higher standards for thought leadership. If your audience is the C-suite, you care about this finding

- Some things about thought leadership are more important to decision-makers than other things. Communicating with a decisive viewpoint is not as vital as basing your thought leadership on real-world experiences, case studies and examples, for instance

Step 7: Publish

Thought leadership is only effective if it’s published. Thought leaders are only effective when people hear their ideas. You can publish a foundational asset, such as a whitepaper or research report. Or, you can play the long-game and publish multiple pieces, at strategic intervals. And remember that thought leadership doesn’t have to be organic to attract eyeballs. You can use a mix of both organic and paid channels to spread your thought leadership.

Step 8: Refine and reiterate

One thing to note is that thought leadership that’s based upon original research and data is rarely a one-and-done exercise. The shelf life of most thought leadership is short. To stay relevant, your thought leadership must always be current. This means revisiting your research at timely intervals, and revising the data/insights as needed. To get the most from your thought leadership, you must keep it fresh by uncovering new and deeper insights, and publishing again.

Conclusion

Original research and data are the backbone of effective thought leadership in the B2B manufacturing ecosystem. By establishing a clear thesis, employing rigorous research methods, avoiding bias, and transforming raw data into actionable insights, you create thought leadership that elevates your authority, fosters trust and drives meaningful engagement with your audience.

RH Blake exemplifies this approach through our 2025 Thought Leadership in Manufacturing Report, where we combine meticulous research with practical insights to deliver value to our audience. Whether you are exploring the impact of thought leadership on decision-making or seeking ways to create your own data-driven content, the principles outlined in this blog post provide a roadmap to success.

Looking to create thought leadership that drives awareness, leads and strengthens your brand? We can help.

For more than 30 years, RH Blake has helped leading organizations in the manufacturing ecosystem build and execute marketing programs that drive targeted awareness, preference, leads and margin expansion. If you’re ready to harness the power of original research and data to bolster your authority and differentiate your brand, we invite you to partner with us. Let’s create the kind of thought leadership that sets you apart in a competitive marketplace.

"You guys met our expectations in every way. It [RH Blake Market Research] was the information we were looking for. Congratulations and Thank You!"

Scott Griggs

Scott Griggs

Director of Services for Food Manufacturing and Food Service

ALS Global

"“I’ve gotten all that I’d hoped for from the RH Blake Growth Roadmap™ and more. Based on the research and insights, we adjusted our offering scope and sales approach. And this adjustment has been effective at generating new opportunities."

Diane Reko

Diane Reko

President

REKO International

"RH Blake has been an outstanding partner. They deliver creativity, on time, and always so professional. We love working with them because of their perspective, support, and their efficiency in turning projects around quickly."

Samantha Spano

Samantha Spano

Digital Product Marketing & Communications Manager

Industrial Automation Energy Industries

ABB

Industrial Marketer’s Guide to Creating an Effective Marketing Program

147 pages of actionable ideas to help you create a winning marketing strategy and program

Industrial Marketer’s Guide to Creating an Effective Marketing Program

147 pages of actionable ideas to help you create a winning marketing strategy and program

Related Clients